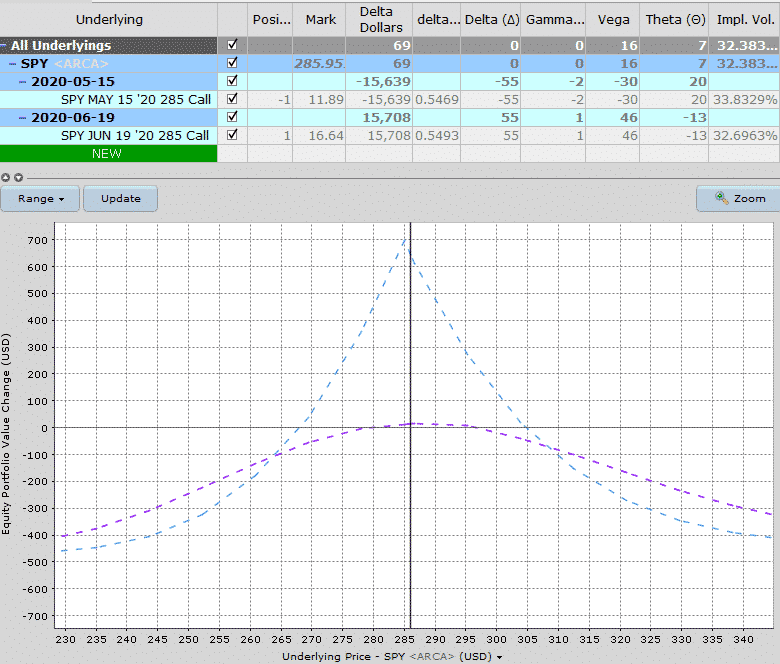

Calendar Spread Payoff Graph

Calendar Spread Payoff Graph. A calendar spread strategy profits from the time decay and/or increase in the implied volatility of the options. A calendar spread (aka time spread, horizontal spread) has different expiration dates but the same strike prices.

What we are looking at. The payoff graph will show you the variation of profit as the price of the underlying changes.

A calendar spread strategy profits from the time decay and/or increase in the implied volatility of the options.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit], A long and a short call, with different expirations, and usually the same strikes. What we are looking at.

Calendar Spread Options Trading Strategy In Python, A long and a short call, with different expirations, and usually the same strikes. This makes sense because the short option obligates the investor to.

Calendar Spread Explained InvestingFuse, In this notebook, we will create a payoff graph of calendar. Instead, you will need to understand this position using the greeks.

Calendar Spreads 101 Everything You Need To Know, The strategy consists of writing a shorter term call option and taking a longer term call option. A call spread has many variations.

Double Calendar Spreads Ultimate Guide With Examples, A long and a short call, with different expirations, and usually the same strikes. You can also use it as a.

What are Calendar Spread and Double Calendar Spread Strategies, A call spread has many variations. The guidelines to read the graph are specified on the page.

Calendar Spreads Option Trading Strategies Beginner's Guide to the, A long and a short call, with different expirations, and usually the same strikes. The calendar spread is unique in that it implements two of the same options and strikes across different expiries, which allows for a few other use cases.

Calendar Spreads Option Trading Strategies Beginner's Guide to the, What we are looking at. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in.

How Calendar Spreads Work (Best Explanation) projectoption, A long and a short call, with different expirations, and usually the same strikes. This makes sense because the short option obligates the investor to.

What are Calendar Spread and Double Calendar Spread Strategies, Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. The calendar spread is unique in that it implements two of the same options and strikes across different expiries, which allows for a few other use cases.

The third graph demonstrates how a call spread results from a combination of a long call (strike x 1) with a short call (strike x 2).